Although your federal tax returns aren’t due until April 18, 2023, there were a lot of changes over the past year that could impact your tax refund. With the end of the year rapidly approaching, now is a great time to get organized for tax season. Read Also: Go Rewards Mastercard Navy Federal These 8 Tax Changes Could Impact The Size Of Your Refund Next Year This will result in lower Federal income taxes for those whose salaries haven’t kept pace with inflation.

With typical inflation adjustments a mere 1-2%, the 2023 Federal income tax brackets have been adjusted for inflation by as much as 10.5%. With inflation at historical highs, the IRS has adjusted Federal tax brackets significantly to account for inflation. When you’re working on your 2022 federal income tax return next year, here are the tax brackets and rates you’ll need: Federal Income Tax Brackets Indexed For Inflation Now, let’s get to the actual tax brackets for 20. So, that’s something else to keep in mind when you’re filing a return or planning to reduce a future tax bill. However, for head-of-household filers, it goes from $55,901 to $89,050. For example, for single filers, the 22% tax bracket for the 2022 tax year starts at $41,776 and ends at $89,075. The 20 tax bracket ranges also differ depending on your filing status. That means you could wind up in a different tax bracket when you file your 2022 federal income tax return than the bracket you were in before which also means you could pay a different tax rate on some of your income. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation. When it comes to federal income tax rates and brackets, the tax rates themselves didn’t change from 2021 to 2022. For most Americans, that’s their return for the 2022 tax year which will be due on Ap. Smart taxpayers are planning ahead and already thinking about their next federal income tax return. What Are The Income Tax Brackets For 2022 Vs 2021ĭepending on your taxable income, you can end up in one of seven different federal income tax brackets each with its own marginal tax rate. If your taxable income increases, the taxes you pay will increase.īut figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above. The amount you pay in taxes depends on your income. Tax brackets were created by the IRS to determine how much money you need to pay the tax agency each year.

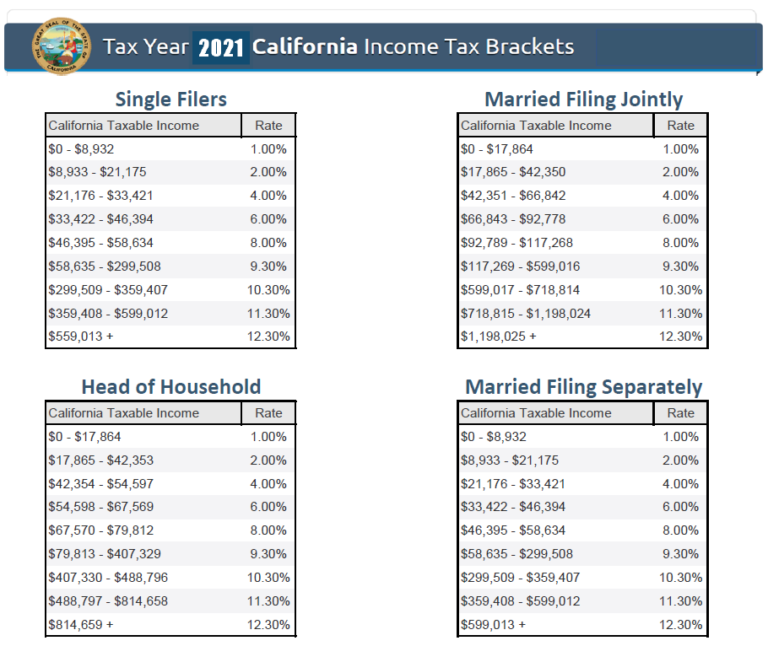

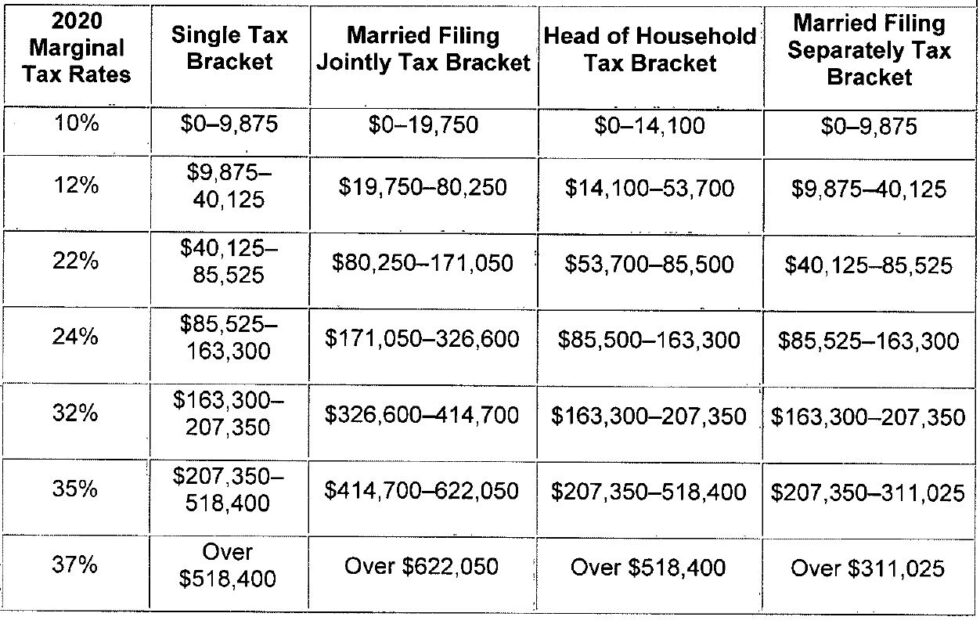

Note, that the 2020 figures below are the amounts applicable to the income earned during 2020 and paid in 2021 when you file your taxes.Excel VLOOKUP for Tax Brackets Year 2021 with Examples This caused the 22% rate bracket for single filer to increase from $81,051 up to $83,551.īelow are the 2020-2022 tables for personal income tax rates. The inflation adjustment factor for 2022 was 3.1% for example. There were no structural changes to the tax brackets in any of the periods, so the only impact are increases year-over-year due to the inflation indexing.

The brackets are adjusted using the chained Consumer Price Index (CPI). There are seven brackets with progressive rates ranging from 10% up to 37% and they are the same over all three years.įederal income tax rate brackets are indexed for inflation. The tax rates over the period are the same. In other words, moving into a higher tax bracket does NOT mean you pay higher taxes on all your income.īelow we will present comparative tables, so you change see the changes across the years, but before we do let’s look at how the rates and brackets have changes over the periods. In other words, someone in the 24% marginal rate bracket will pay 10% on part of their income, 12% on another part, 22% on yet another and finally 24% on everything else. Tax brackets work so that you pay part of your income at each level bracket as you move-up in income. Which bracket you are in depends on your taxable income however, your bracket does not equal your tax rate. For the years 2020-2022 there are seven different brackets for each year. The US tax system is progressive, meaning that the more you earn the more you pay.

0 kommentar(er)

0 kommentar(er)